Taxation and infrastructure charging are important for financing the maintenance and development of Europe’s road infrastructure network. With Directive 1999/62/EC, the EU has created a framework to encourage Member States to use taxation and infrastructure charging in the most effective and fair manner, based on the 'user pays' and ‘polluter pays’ principles, as enshrined in the Treaties. It also encourages Member States to tackle the negative impacts of congestion and of air and noise pollution. The framework supports the decarbonisation of road transport and the implementation of the Paris Agreement.

Although the application of tolls and vignettes is not mandatory for Member States, the Directive lays down certain rules to be followed by those Member States that wish to levy such charges.

Vehicle taxation

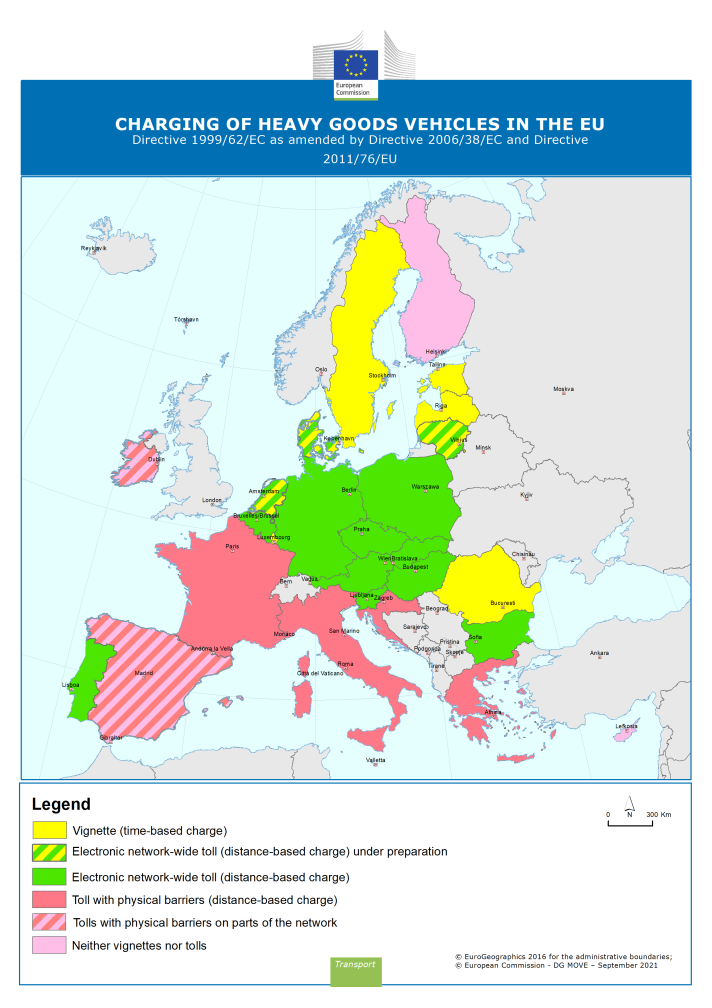

The Directive helps ensure that the internal market functions as it should by reducing differences in the levels of the annual heavy-goods vehicle taxes applicable within Member States. It provides minimum rates for the annual vehicle tax (also known as circulation tax or ownership tax) on heavy goods motor vehicles and vehicle combinations (articulated vehicles and road trains). This is set according to the number and configuration of axles, and the maximum permissible gross laden weight. The national authorities alone are responsible for setting the structure of taxes and the procedures for levying and collecting them.

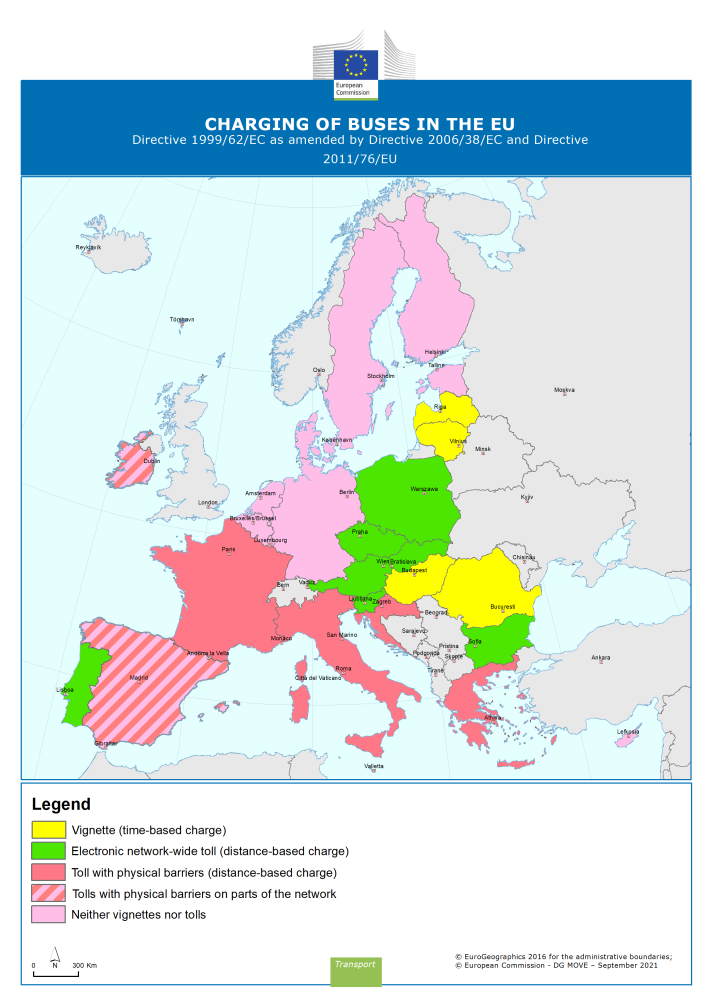

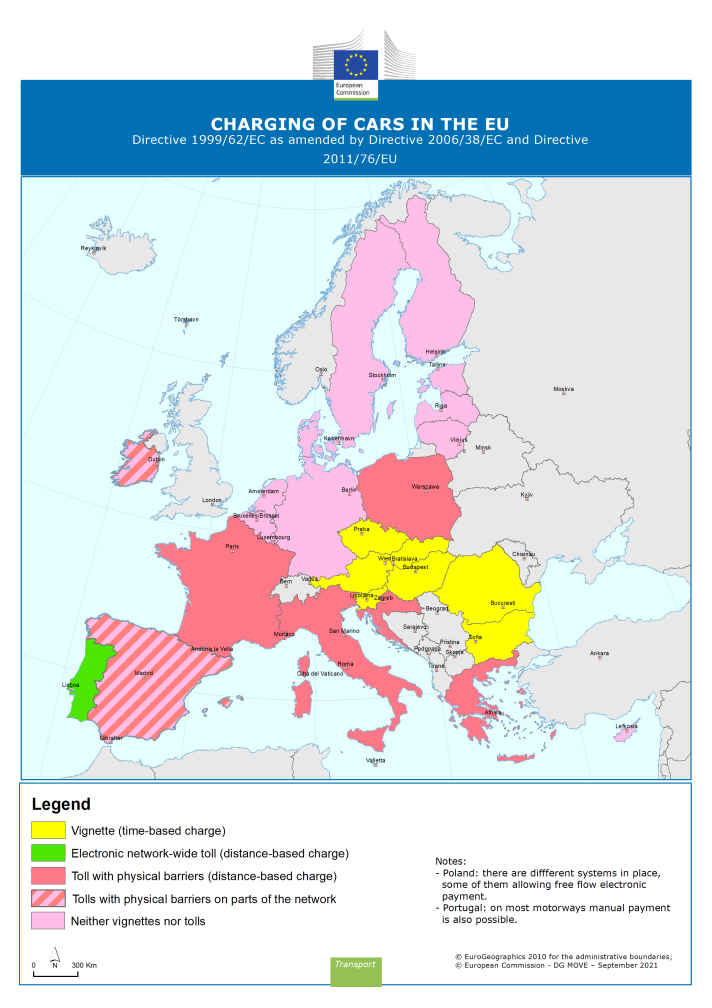

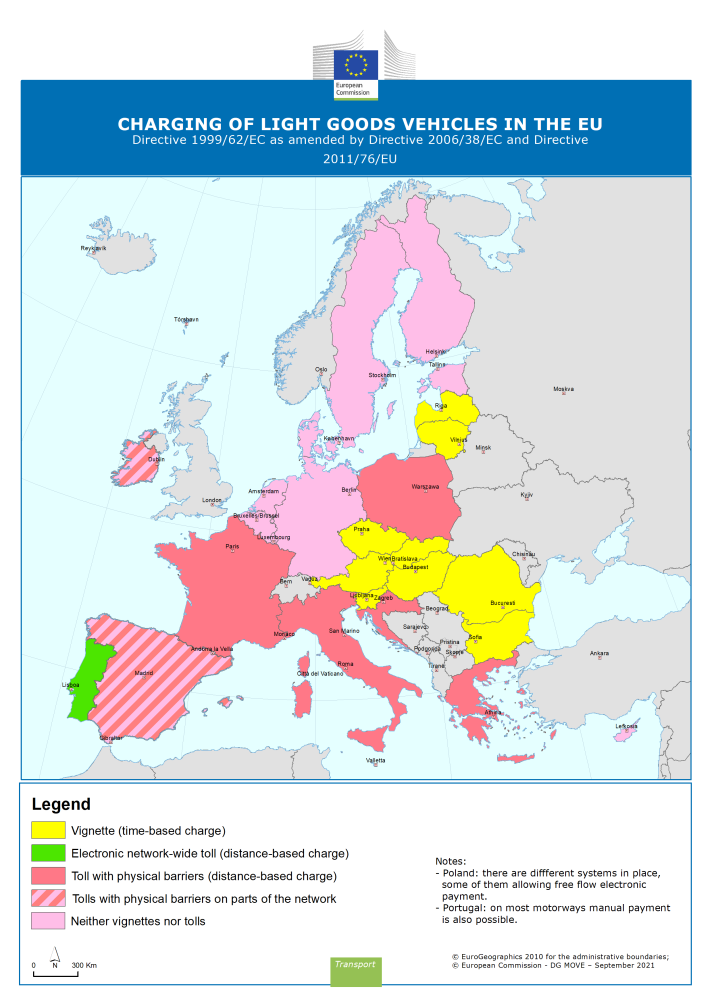

Road charges: tolls and vignettes

Directive 1999/62/EC sets common rules on distance-based charges (tolls) and time-based user charges (vignettes) for the use of road infrastructure. These rules stipulate that the cost of constructing, operating, and developing infrastructure can be recovered through tolls and vignettes. The rules are generally stricter for charges applied on the TEN-T road infrastructure and motorways than for charges applied on other roads. Directive (EU) 2022/362 extended the rules to include passenger cars and removed an exemption from those rules for small heavy-duty vehicles.

Directive 1999/62/EC stipulates that:

- Tolls must be levied according to the distance travelled and the type of vehicle, while vignettes are scaled according to the duration of the use of the infrastructure. Vignettes must be phased out from the TEN-T road network by 2030, with some specific exceptions.

- From 2024 onwards, tolls and vignettes for heavy-duty vehicles must be varied based on a vehicle’s CO2 emissions. This rule is optional for light-duty vehicles, except for minibuses and vans, for which it must be implemented by 2026.

- From 2026 onwards, the external cost of air pollution must be included in tolls for heavy-duty vehicles.

- National tolls and vignettes must not discriminate against international traffic; in particular, the price of short-term vignettes should be proportionate so as not to discriminate against occasional users. Exemption from the obligation to pay charges or reduced charges can only be granted in specific cases and excessive rebates on tolls are forbidden.

- Charging schemes should cause as little hindrance as possible to the free flow of traffic, avoiding mandatory checks at the EU’s internal borders; where economically feasible, they should be collected by means of an electronic road toll system.

- For heavy-duty vehicles, the maximum average tolls must be set in relation to the costs of constructing, operating, and developing the infrastructure concerned. Mark-ups may be applied to finance the transport infrastructure of the core trans-European transport network;

- The Member States must notify the Commission of new or substantially amended tolling schemes at the latest six months before their implementation.

- Tolls may include an external cost charge that reflects the cost of air and noise pollution, as well as a congestion charge.

- The revenue of mark-ups and congestion charges must be reinvested in the transport sector, while the remaining revenues collected under the Directive should be used to develop the trans-European network.

Legislation

Consolidated version of Directive 1999/62/EC of the European Parliament and of the Council of 17 June 1999 on the charging of heavy goods vehicles for the use of certain infrastructures.

Directive (EU) 2022/362 of the European Parliament and of the Council of 24 February 2022 amending Directives 1999/62/EC, 1999/37/EC and (EU) 2019/520, as regards the charging of vehicles for the use of certain infrastructures.

Directive 2011/76/EU amending Directive 1999/62/EC on the charging of heavy goods vehicles for the use of certain infrastructures.

Directive 2006/38/EC amending Directive 1999/62/EC on the charging of heavy goods vehicles for the use of certain infrastructures.

Directive 1999/62/EC of the European Parliament and of the Council of 17 June 1999 on the charging of heavy goods vehicles for the use of certain infrastructures

Informative Notes

Informative note detailing the thresholds of CO2 emission classes, as defined in Article 7ga of Directive 1999/62/EC of the European Parliament and of the Council of 17 June 1999 on the charging of vehicles for the use of road infrastructures as amended by Directive (UE) 2022/362.

Road charging in the EU

Policy and other related documents

Road transport emissions: Road charging advantages for efficient trailers

Study on Impacts of application of the vignette systems to Private Vehicles

Study on Assessment of vignette systems for private vehicles applied in the Member States